American Honda reported 2,472 sales of its all-new, second-generation Ridgeline pickup in June 2016, the truck’s first month of rather limited availability.

June was the Ridgeline’s first four-digit sales month since August 2014, the Ridgeline’s first month above the 2,000-unit mark since October 2008, and the best Ridgeline sales month since August 2008.

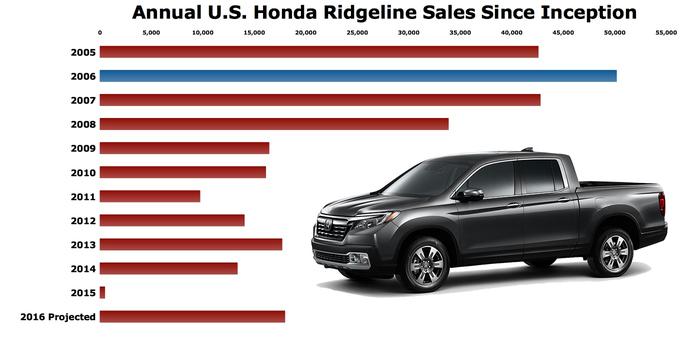

In fact, if American Honda simply maintained the June 2016 sales pace for the rest of the year, total 2016 calendar year Ridgeline sales would essentially match 2013’s total for an eight-year high in U.S. Ridgeline sales.

Indeed, on an annualized rate, based simply on the Ridgeline’s first month back from a long hiatus, Honda is already selling more Ridgelines than at any point since 2008.

Honda will soon be able to sell more Ridgelines. And the truck deserves to sell with far greater frequency than it will. “It’s absolutely phenomenal,” TTAC’s managing editor, Mark Stevenson, wrote after a San Antonio test drive. “The interior of the Ridgeline is vast,” he said. Torque vectoring, Mark wrote, is, “a freak-of-nature feature in the pickup truck segment that gives the unibody truck an unfair advantage when it comes to handling.”

But there are two key factors which will limit Ridgeline volume. First, Honda’s own production limitations. Second, though there’s a bed on the back, the Ridgeline is a unibody vehicle turned into a pickup truck, not a conventional body-on-frame truck like every other pickup on sale in the United States.

PRODUCTIONHonda builds the Ridgeline at its Alabama plant where it also assembles Pilots, Odysseys, and Acura MDXs. (Honda will increase Ridgeline capacity once it moves some MDX production to Ohio.) According to the Automotive News Data Center, Honda only earmarked 12 percent of its Lincoln plant’s production capacity for the Ridgeline in May, the truck’s first month of production. Honda isn’t going to severely alter the production formula to further constrain supply of the Pilot and Odyssey, two higher-volume products, in lieu of a Ridgeline for which Honda has admitted it has “modest sales expectations.”

Ridgeline sales maxed out at 50,193 units in 2006, the first-generation’s first full year. Honda would like to get back to that level, which would require adding to June’s volume by approximately 70 percent.

Based on the brief sampling period of June, it doesn’t appear as though the Ridgeline will eat into the continued growth achieved by traditional small/midsize pickup trucks.

ALTERNATIVESExcluding the Ridgeline, sales of a midsize quartet — Tacoma, Colorado, Frontier, Canyon — jumped 24 percent to 36,422 units in June, equal to 16 percent of the U.S. pickup truck market last month.

Including the Ridgeline, sales of non-full-size pickups shot up 32 percent, a gain of 9,401 units versus the full-size sector’s 10-percent improvement, an increase of 16,466 sales powered largely by the Ford F-Series. The midsize sub-segment’s market share grew to 17.3 percent from 14.8 percent a year ago thanks to the addition of the Ridgeline, a 37-percent jump from the GM twins and an 84-percent Nissan Frontier uptick; despite flat Tacoma sales.

The Ridgeline is selling like it’s 2008, surging well beyond the post-recession “achievements” of Honda’s first-gen pickup. But it remains and will likely remain a relative bit player in the pickup truck arena. Only 6.4 percent of the midsize pickups and 1.1 percent of all pickup trucks sold in June 2016 were Hondas. Even if Honda managed to climb back to its best-ever sales pace, don’t expect the Ridgeline’s share to rise above 2 percent.

For Honda, if the Ridgeline doesn’t crumble after rising to such a level, that will be enough.

[Images: © 2016 Mark Stevenson and Timothy Cain/The Truth About Cars, Toyota]

Timothy Cain is the founder of GoodCarBadCar.net, which obsesses over the free and frequent publication of U.S. and Canadian auto sales figures. Follow on Twitter @goodcarbadcar and on Facebook.